Building a resilient payment infrastructure

Looking for a payment infrastructure that works better for you? You want something robust, secure, and holistic so that you can continue to build your business. And naturally, you want it without the hassle of being constantly tied up with customer service because you experience problem after problem!

If you want to learn about the best practices, technology, and tools available that add up to a resilient payment infrastructure, read on. You’ll learn all about what makes a payment infrastructure resilient and what kevin. might be able to help you with.

What is a resilient payment infrastructure?

A resilient payment infrastructure is one that can operate with little disruption. This can be achieved by using strategies such as fault tolerance, scalability, redundancy, monitoring, and more, all described below.

The goal of having resiliency in payment infrastructure is to ensure that all payments end customers make to a business go through seamlessly and securely. At kevin., our goal is to make sure uncompleted payments are as minimized as possible.

How do we do that? Let’s take a look.

Key factors to consider in building a resilient payment infrastructure

If you’re looking to understand what makes a resilient payment infrastructure, there are some key factors involved. These are described in detail below.

1. Fault tolerance

A payment infrastructure system should be able to operate at least partially, even if one of the components fails (including external dependencies). Think of it this way: if your bank has a technical problem, other bank integrations should still work. How can you do this? Split your system into smaller independent units, like microservices architecture.

2. Scalability

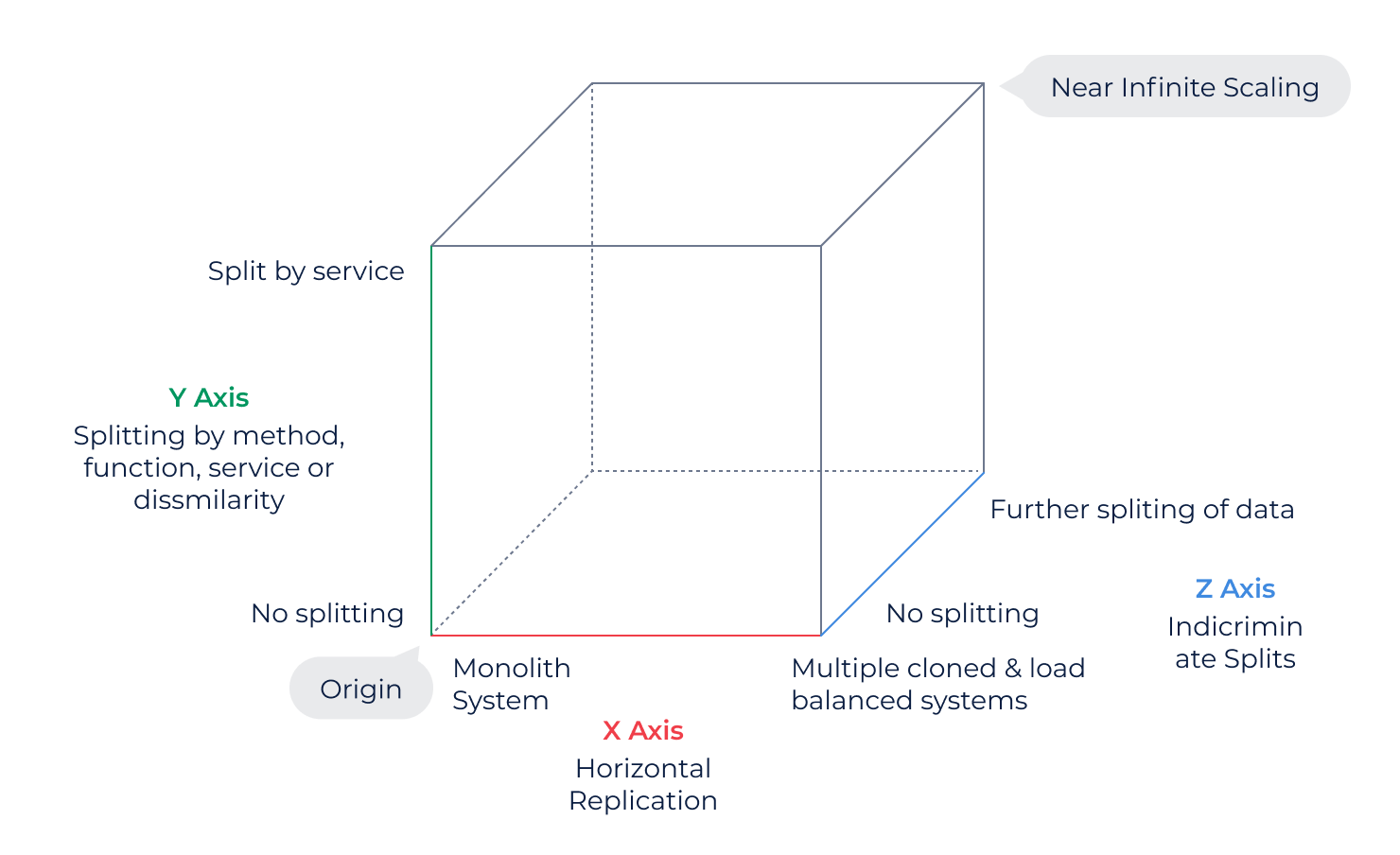

Your system should be able to scale automatically based on all incoming traffic. How can this be achieved? Many look to the scale cube, which helps break the application down into smaller, more manageable pieces.

The scale cube demonstrates how to scale an application in three dimensions: X, Y, and Z. When each dimension is addressed, it adds up to better performance, reliability, and availability. Let’s detail each of the axes in turn.

X-axis

The X-axis is all about replicating and cloning. This can be automatically scaled through the use of, for example, container orchestration tools.

Y-axis

The Y-axis splits the application into a number of separate services, with each service performing only a subset of operations of the whole system. You can scale the Y-axis through having microservice architecture.

Z-axis

The Z-axis involves splitting the system load (for example, requests or persistent data) into partitions, where each partition is processed on a single replica. Scaling the Z-axis is complex and difficult to implement. It is, however, not typically required for user-facing components. It’s usually used for scaling databases and data analytics.

3. Redundancy

All critical components, such as payment handling services and databases, should have a high-availability setup. This factor relates to scalability because a horizontally-scaled service has built-in redundancy. A database with read replica in a different availability zone may serve as a backup in case of zone failure.

4. Quality

Quality should be built into the product. That means testing and quality assurance aren’t separate steps in the software development process. Instead, they're practices embedded into each step of the software lifecycle. All people involved in the process should be responsible for ensuring product quality.

5. Security

Just like quality, security should be built into the product and all processes involved rather than imposed externally. Any unauthorized access to the payment infrastructure is an obvious threat to resiliency.

6. Processes

There should be well-established processes in place, such as disaster recovery, incident handling, and release handling. This allows for a significant reduction in downtime when unexpected problems crop up.

7. Monitoring

The robust monitoring of payment infrastructure on both a technical and business level is crucial when it comes to ensuring the availability of services. Why? Two reasons:

- It allows for a reaction to potential problems before it reaches the user

- It allows for a reduction of the time required to deal with a problem once it occurs

8. Automation

A resilient infrastructure requires widespread automation in all of the above areas. Human reaction is often too slow for a system to operate without interruption under a high load.

Advantages of A2A payments in building a resilient payment infrastructure

What do account-to-account payments with kevin. have to offer when it comes to payment infrastructure resilience? Plenty!

No dependence on third-party services

kevin. doesn’t rely on third-party services to operate. To understand why that’s important, we turned to our expert team.

“Reducing the number of parties (like card issuers and POS terminal operators) involved in the payment process means removing dependency on their systems. Less moving blocks means better resiliency.”

–Kamil Noster, Senior Software Engineer

Increased control over payment processing

kevin. doesn’t use third parties, which means greater control over payment processing. And with a resilient system in place, that means less disruption for your business operations.

Improved security

Safety and security are always at the forefront of what we do at kevin. As a business, you don’t want to have to worry about security for your sake or the sake of your customers. Thanks to kevin.’s robust security measures, you won’t have to.

Build your business with kevin.’s resilient payment infrastructure

To benefit your business the most, a payment infrastructure has to strike a balance between quality and efficiency. At kevin., we’ve kept all the key factors in mind, building them into each part of our processes. Interested in finding more about how resilient kevin. is? Get in touch with us today!