The history & development of online payments

Recently, the payments industry in Europe has gone through quite a bit of transformation. The digital landscape simply wouldn’t be where it is today without the variety of payment solutions available now.

Over a relatively short period of time, the digital payments era began and took off quickly. Most people can’t imagine a world where goods and services aren’t freely found and purchased online.

Thanks to convenience, speed, safety and efficiency, digital payments have continued to strengthen as the use of physical cash declines. Let’s take a look at the development of digital payments from the very beginning up to today, and all the way to their bright, innovative future.

The first e-commerce transaction

There is much debate about which was the first e-commerce transaction. Some cite Dan Kohn, an entrepreneur who sold a Sting CD online in 1994 and was paid by use of a credit card to complete the transaction. On the purchase site, the customer downloaded a special browser to make the transaction secure.

Others say the first was Pizza Hut, which began selling pizzas online in August 1994. Still others say that the Internet Shopping Network was the pioneer of e-commerce transactions, while CDconnection.com claims they have been selling CDs online since 1990.

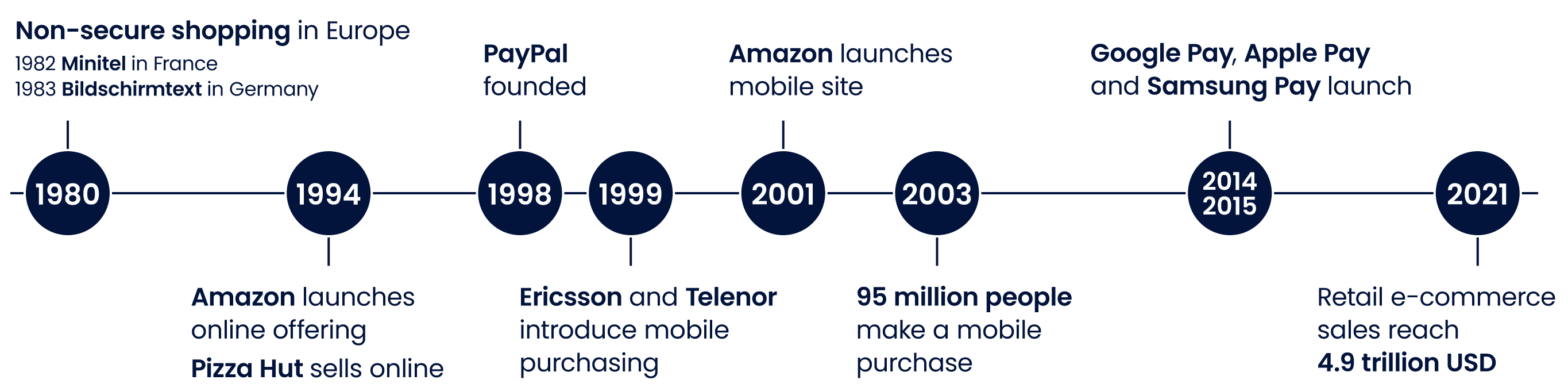

In Europe, however, non-secure shopping was already happening online as early as the 1980s. Terminal-based services including Germany’s Bildschirmtext (launched in 1983), and Minitel in France (launched in 1982), offered various services including the ability to purchase air and train tickets.

The year 1994 is also when Amazon launched its online offering, starting out as a bookstore before growing into the giant it is today. PayPal was founded in 1998, and a year later was launched as a platform to transfer money. By the time the early 2000s came around, e-commerce had truly taken off. Consumers were routinely shopping online and conducting secure transactions without having to step foot in stores.

In 1999, Ericsson and Telenor were the first mobile companies to introduce mobile purchasing, first for movie tickets. Amazon launched a mobile site in 2001, with many other companies capitalising quickly on this trend. It was just two years later, in 2003, that 95 million people around the globe had completed a mobile purchase.

Since mobile shopping seemed to be here to stay, it’s no wonder that the digital wallet was developed. Google Pay, Apple Pay and Samsung Pay were launched in 2014 and 2015 and became popular in just a few years. All are widely used by consumers and accepted at retailers as a routine payment method.

Legacy payment systems

It should be stated that early payment systems weren’t like those we are used to using today. Legacy payment systems are those developed years ago that simply can’t keep up with the current needs of modern-day consumers. For example, the first online payment systems required highly specialised knowledge in the areas of data transfer protocols or encryption.

Since then, payment systems have changed, but they often remain inflexible and unadaptive to merchant and customer needs alike.

Today’s e-commerce landscape

Since the beginning of online payments, it’s safe to say that things have changed in the payment landscape. In 2021, retail e-commerce sales reached 4.9 trillion USD. Though it may have started with a CD or a pizza depending on whose side you’re on, the rapid growth of online shopping means digital payments have become the norm.

Online retailers have increasingly offered a broader range of payment methods. Consumers demand various choices when it comes to payments, and e-commerce merchants have risen to meet those demands.

Looking to the future, convenience and safety will continue to be at the forefront of online payments. E-commerce retailers must seek to provide quick access to their products, which means keeping a pulse on the changing payments landscape, and offering frictionless, secure options such as account-to-account payments.

In the past, a merchant collecting online payments would need to work with three separate parties: an acquirer, a payment gateway and a payment processor.

Today, however, there are solutions like kevin., who can cut out the intermediaries to make the payment process quicker for merchants and customers alike. Merchants need only have one point of contact for any concerns that come up as well, reducing hassle and streamlining communications.

The future of e-commerce payments

The needs and requirements of customers are ever-changing. The future of e-commerce payments will need to continue to evolve with these needs for businesses to stay on top of their game. If not, chances are that a potential customer will go to a competitor that offers their preferred payment methods.

Looking at the growth of open banking all over Europe, it’s clear that account-to-account payments are going to be key in the future for e-commerce. That’s where kevin. can help businesses stay ahead of the competition.

By transferring funds from a customer account directly to the business account, transactions are completed quickly, safely and without friction - easy and simple for both consumer and merchant alike. With kevin. account linking, the customer links their bank account rather than using a card for a transaction. As such, there are no card scheme fees, and the transfer doesn’t wait for days or weeks to go through.