What is a payment initiation service (PIS)?

Open banking and PSD2 have laid the groundwork for new payment methods. One of them is the payment initiation service (PIS), which brings various benefits to businesses and consumers that deal with digital payments.

Online merchants widely use PIS because it creates a convenient payment flow for their consumers while minimizing the payment acceptance fees for the businesses. The service grants licensed third-party service providers immediate, short-term access to the payee’s account to initiate payments on behalf of the buyer.

In this guide, you’ll find all the main information about PIS. To help you better understand how the PIS works, we’ll explain what benefits it brings to merchants and consumers, share examples of payment initiation service providers (PISPs), and explain the difference between them and account information service providers (AISPs).

What is a payment initiation service?

Payment initiation service (PIS) is a payment option made possible by open banking. PIS enables consumers to pay for goods or services directly from their bank account without leaving the merchant’s app or website.

Payment initiation service providers (PISPs) are authorized third-party service providers that enable these direct payment transfers via secure APIs. PISPs are a link between merchants and consumers, which enables direct bank transactions. It’s important to note that a PSP cannot initiate transactions without a consumer’s consent.

How does the payment initiation service work?

From the buyer’s perspective, the payment initiation service creates a simple and convenient payment flow. How does it work?

After adding goods or services to their shopping cart, the consumer proceeds to the checkout. If the merchant has integrated a PIS, such as kevin.’s online payment gateway, the buyer is then prompted to choose their bank. For example, kevin. covers banks in all the EU countries, meaning that merchants can accept payments from different banks anywhere across Europe.

Depending on the bank, the checkout process may slightly differ, but in most cases, the consumer will be redirected to their bank’s login page to confirm the payment. In other cases, the buyer may be able to enter their login information straight into the payment window without being redirected to the bank’s page.

Once the payment is confirmed, the consumer is taken back to the merchant’s page. In most cases, the payment confirmation email instantly arrives in the buyer’s inbox.

Merchants can easily integrate kevin.’s web payment infrastructure or choose a mobile payments solution. The onboarding process is quick and straightforward via kevin.’s self-onboarding dashboard. Once integrated with kevin., merchants can offer their buyers the option of paying for goods and services via their bank with just a few clicks.

Payment initiation service providers: Examples

Payment initiation service providers (PISPs) are authorized third-party service providers that work as intermediaries between banks and merchants. They enable direct money transfers from the consumer’s bank account to the merchant’s account via application programming interfaces (APIs). The APIs are created and provided by the banks, and the payment initiation is only possible with the consumer’s permission.

The PISPs started to appear since PSD2 provided the basis for open banking in Europe. Open banking has created new opportunities for authorized financial service providers to step into the market and offer innovative payment solutions. Many companies have taken this opportunity.

The core element that makes PIS possible are banking APIs. They enable PISPs to initiate transfers in real-time. PISPs create “one-window” connections for merchants to all banks that are integrated into PISP via APIs.

kevin. is an example of how PISPs can improve the payment experience and benefit merchants. For example, kevin. clients allow their consumers to pay for merchants’ goods and services directly from their bank account, without the need to enter any card details. Meanwhile, merchants that use kevin. services bypass expensive card processing fees and can provide their customers with a frictionless checkout flow.

What is the difference between PISPs and AISPs?

To explain the difference between PISPs and account information service providers (AISPs), let’s first look into the definition of AISPs.

AISPs are companies that have access to consumers’ account information provided by their banks. This information is only given to AISPs with explicit consumer consent. The AISPs can see data such as bank accounts, transactions, and account balances. This information is helpful for companies that need to get a wholesome view of the consumers’ financial standing regardless of how many bank accounts they have.

Essentially, the main difference between PISPs and AISPs is that PISPs have “read-write” access to consumer accounts, meaning that they can initiate authorized transactions on consumers’ behalf. Meanwhile, AISPs have “read-only” access, which means that these companies can only see the information but cannot initiate any actions.

What are the benefits of the payment initiation service?

PIS brings various benefits to both merchants and their consumers. Let’s see what advantages PIS offers to each of those:

To the buyer

- Improved checkout flow — consumers no longer have to make manual money transfers or enter their card details during checkout. They can simply select a bank account from which they wish to pay and confirm the payment.

- Better security — PISPs feature robust security measures, such as tokens, to reduce payment fraud rates. Consumers also don’t have to provide their payment card details, which eliminates the risk of someone else using their card data for payments.

To the seller

- Competitive pricing — PIS removes all the bank fees associated with payment processing and makes payments more transparent. Merchants also don’t need to pay card processing fees since consumers pay via their bank accounts. Moreover, the rising number of PISPs in the market creates a competitive environment. Some providers offer a better price for merchants, so they would choose their services.

- Improved security — PISPs ensure robust security by encrypting payment data and using tokens, which minimises the risk of payment fraud, compared to card payments. Service providers also comply with PSD2 security requirements, such as multi-factor authentication.

- Wide coverage — depending on their coverage, PISPs can enable merchants to accept payments from different banks in various countries. For example, kevin. covers banks in all the EU countries, so merchants can accept payments from clients in different locations with no additional cost.

- Quicker launch — by integrating with PISPs, companies can quickly launch into multiple European markets since they don't need to establish relationships with each bank and card acquirer individually.

Security of payment initiation services

Security is one of the core features of payment initiation services. To understand better, let’s look into two main factors that ensure the PIS security:

The second payment services directive (PSD2)

PSD2 laid the foundation for the current PIS landscape. The directive made it possible to open up the data that, historically, banks only kept to themselves. This data was made available to authorized third-party service providers, and, naturally, it raised security concerns for many. However, PSD2 doesn’t make the data more vulnerable. On the contrary, PSD2 implies new security measures because enhancing consumer protection and reducing fraud rates are two of the main PSD2 goals.

Strong customer authentication (SCA)

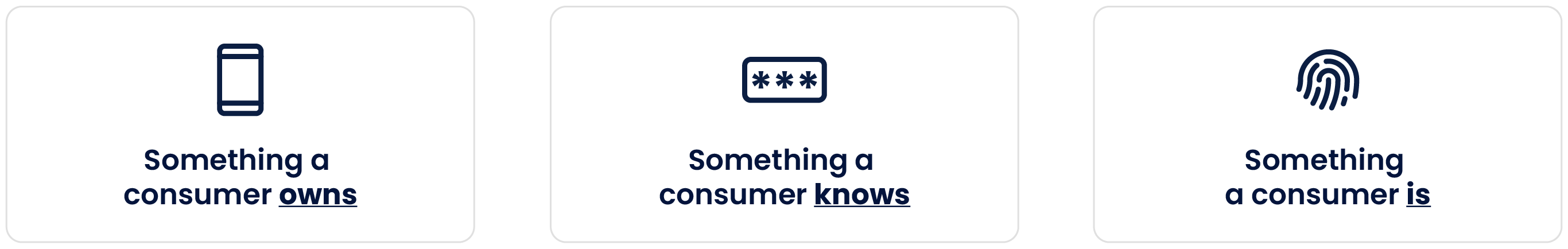

To ensure improved consumer protection and lower fraud rates, PSD2 enforced the implementation of strong customer authentication (SCA). This security feature applies to all online payments. It requires consumers to confirm their identity by providing two out of three independent factors: something they own, something they know, and something they are. SCA brings more security to online payments without compromising the user experience.

Accepting payments with kevin.

Using a payment service provider for accepting digital payments is the best way for merchants to save time and money while providing a seamless checkout experience for their customers. kevin. offers a cost-effective and secure payment infrastructure that covers every EU country. This enables kevin.’s clients to scale across Europe quickly.

Security is one of the top priorities for kevin. We have implemented robust security measures for payment fraud protection to ensure compliance with the highest security standards. Our innovative services cover payment initiation and more. Get in touch, and we’ll offer the best payment solution for your business.